Introduction

The legal doctrine of acknowledgment of debt occupies a pivotal position within the jurisprudence of limitation law in India. Codified under Section 18 of the Limitation Act, 1963, this provision facilitates the extension or revival of a limitation period in circumstances where a debtor expressly or impliedly admits liability. The acknowledgment operates not as the creation of a new obligation but as a reaffirmation of an existing enforceable right, thereby furnishing a renewed timeframe for initiating legal proceedings.

Conceptual Framework

The term “acknowledgment of debt” signifies an unequivocal admission of an extant liability, rendered in writing and authenticated by the debtor or an individual duly authorized to act on their behalf. Jurisprudentially, this acknowledgment does not introduce a new legal relationship but rather revitalizes an antecedent obligation, permitting the computation of a fresh limitation period from the date of acknowledgment.

Statutory Mandate: Section 18 of the Limitation Act, 1963

🔹 Subsection 18(1):

“Where, before the expiration of the prescribed period for a suit or application in respect of any property or right, an acknowledgment of liability in respect of such property or right has been made in writing signed by the party against whom such right is claimed, a fresh period of limitation shall be computed from the time when the acknowledgment was so signed.”

🔹 Explanatory Provisions:

Acknowledgment may remain valid notwithstanding that:

The precise nature of the right is not delineated.

There is a conditional or partial denial of liability.

It is addressed to a third party.

It includes a set-off or counterclaim.

The term “signed” encompasses signatures by agents duly authorized to bind the principal.

Essential Conditions for Valid Acknowledgment

The legal effectiveness of an acknowledgment under Section 18 is contingent upon the fulfillment of the following requisites:

Written Form Requirement: Acknowledgment must be reduced to writing; oral statements are devoid of legal efficacy under this provision.

Authentication via Signature: The acknowledgment must bear the signature of the person against whom the liability is claimed or of their legally empowered agent.

Temporal Validity: The acknowledgment must be executed prior to the expiration of the original limitation period. A post-limitation acknowledgment is inconsequential.

Existence of a Subsisting Obligation: There must be an acknowledgment of a liability that is alive and not merely historical or extinguished.

Permissibility of Implied Acknowledgment: Courts may infer acknowledgment from correspondence, behavior, or documentary evidence even if the terms are not explicit, provided the intent to admit liability is reasonably discernible.

Legal Consequences of Acknowledgment

Recomputation of Limitation Period: A fresh limitation period commences from the date of the valid acknowledgment.

No Creation of New Right: The acknowledgment does not engender a new cause of action; it solely revives the remedial pathway for enforcing an existing obligation.

Continuity of Original Liability: The debtor’s liability remains unaltered and enforceable; acknowledgment merely reactivates the creditor’s right to seek redress.

Landmark Judicial Pronouncements

🔹 Bhagwan v. Madhav (1922, Bombay HC)

Held that acknowledgment may be implied from conduct and need not be overtly explicit.

🔹 Union of India v. Seyadu Beedi Co. (1970, Madras HC)

Held that a letter requesting settlement does not amount to acknowledgment in the absence of liability admission.

🔹 Kishori Engineering Works v. Bank of India (1991, Patna HC)

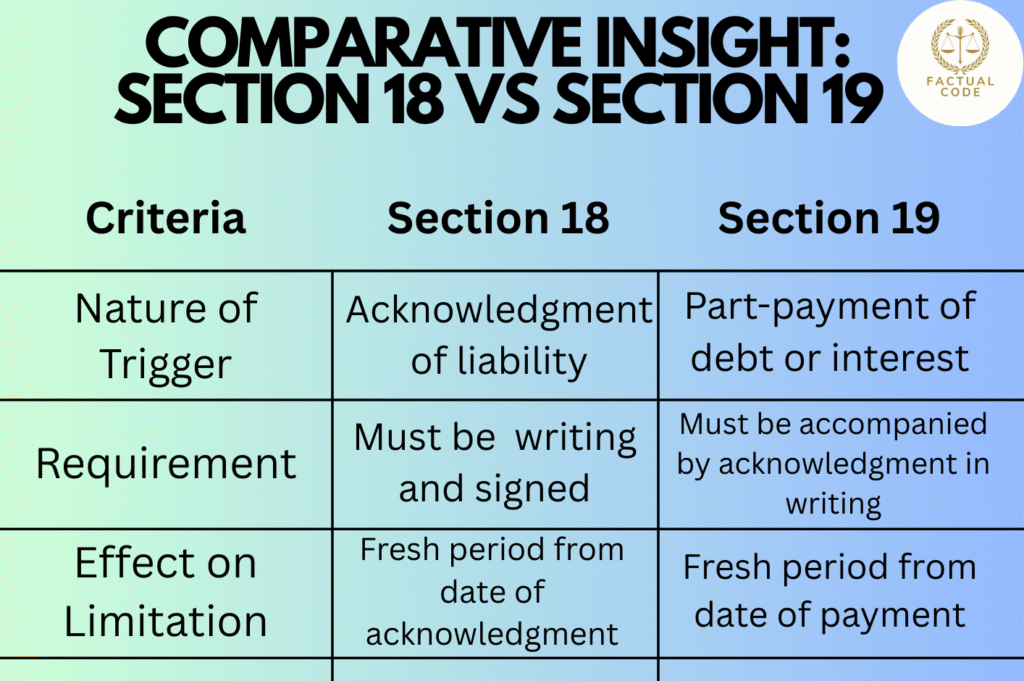

Part-payment within the period of limitation constitutes valid acknowledgment under Section 19.

🔹 Tilak Ram v. Nathu (AIR 1967 SC 935)

The Supreme Court emphasized that acknowledgment must reflect a conscious and deliberate admission of subsisting liability.

Juridical Rationale and Interpretative Philosophy

The ethos underpinning Section 18 is anchored in the principles of equity, good conscience, and substantive justice. The judiciary adopts a purposive and liberal interpretative approach, aimed at precluding unjust enrichment and preserving legitimate claims. Courts meticulously scrutinize the factual matrix to ascertain whether the acknowledgment is bona fide and indicative of continued liability.

Conclusion

In summation, the doctrine of acknowledgment of debt under Section 18 of the Limitation Act operates as a pragmatic mechanism to balance the equities between creditor and debtor. By permitting the extension of the limitation period upon a valid acknowledgment, the statute fosters fairness while dissuading strategic evasion of obligations. For law students, advocates, and scholars, mastering this provision is indispensable for both procedural acumen and substantive legal analysis.

👉 Pro Tip for Students:

To secure high marks in exams, always supplement your answers with statutory text, requisite conditions, illustrative case law, and comparative discussion on related sections such as Sections 19 and 20.

Recommended Posts

Understand what constitutes a valid acknowledgment under Section 18 of the Limitation Act and explore its essentials and procedural aspects.

Explore how limitation periods are computed under the Limitation Act, including exclusions, extensions, and relevant case laws.

Learn how fraud or mistake impacts the commencement of the limitation period under Sections 17 and related provisions.

A concise overview of key features of the Limitation Act including applicability, objectives, and structure.

Understand how time continues to run despite certain interruptions and why it's important for limitation purposes.