On 23rd July, Finance Minister Nirmala Sitharaman presented the 2024 Budget, which has sparked significant public debate. Many are concerned about how it affects the middle class and why it appears the rich are getting richer while the poor get poorer. Let’s break down the key aspects of this budget and its tax implications.

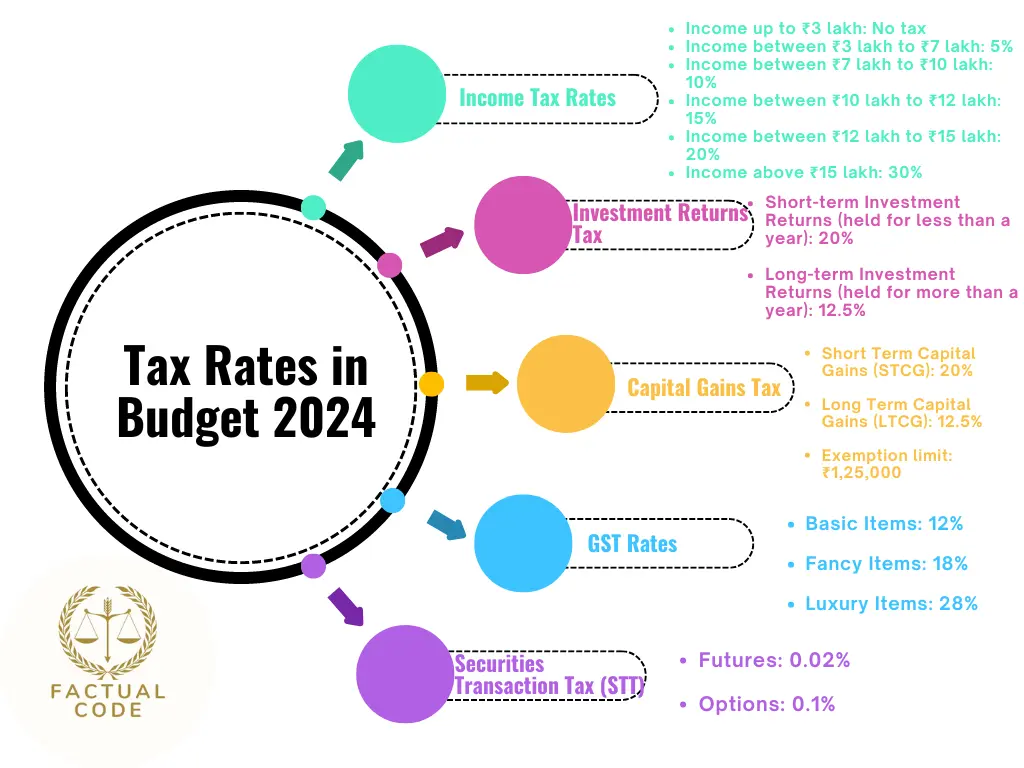

Direct Taxes:

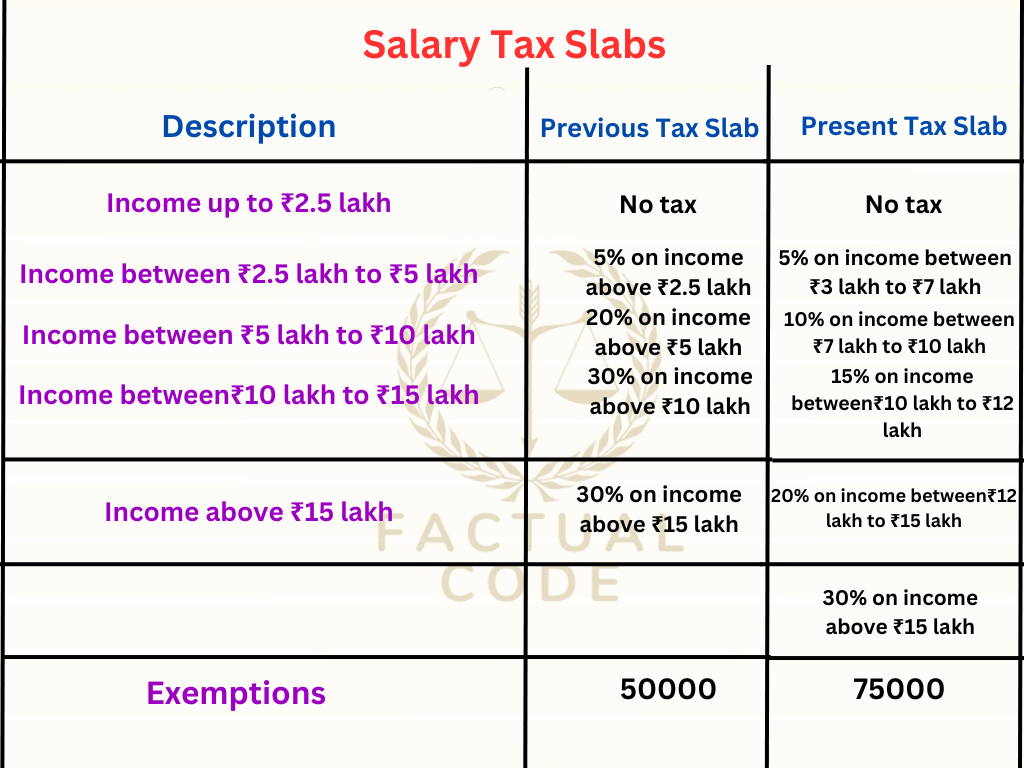

Salary Tax:

Tax Slabs for FY 2024-25:

- Income up to ₹3 lakh: No tax

- Income between ₹3 lakh to ₹7 lakh: 5% tax rate

- Income between ₹7 lakh to ₹10 lakh: 10% tax rate

- Income between ₹10 lakh to ₹12 lakh: 15% tax rate

- Income between ₹12 lakh to ₹15 lakh: 20% tax rate

- Income above ₹15 lakh: 30% tax rate

Investment Returns Tax:

Short-term Investment Returns (held for less than a year):

- Tax Rate: 20%

- Example: If you earn ₹50,000 from an investment within a year, you pay ₹10,000 in taxes.

Long-term Investment Returns (held for more than a year):

- Tax Rate: 12.5%

- Example: If you earn ₹50,000 from an investment held for more than a year, you pay ₹6,250 in taxes.

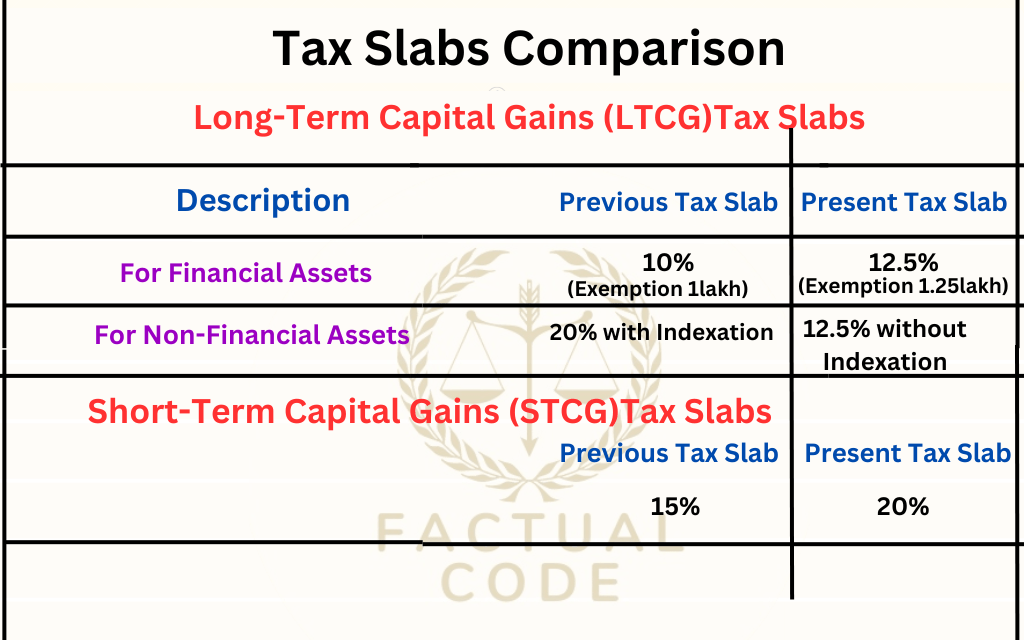

Capital Gains Tax:

Short Term Capital Gains (STCG):

- Increased from 15% to 20%:

- Example: If your short-term capital gains are ₹50,000, you pay ₹10,000 in taxes.

Long Term Capital Gains (LTCG):

- Increased from 10% to 12.5%:

- Example: If your long-term capital gains are ₹50,000, you pay ₹6,250 in taxes.

- Exemption limit increased: From ₹1,00,000 to ₹1,25,000 per financial year.

- Example: If your long-term capital gains are ₹1,50,000, you only pay tax ₹25,000.

- For the non-financial assets(Land, Gold)Tax rate decreases from 20% to 12.5%

Capital Gains and Indexation

Imagine you are a diligent investor named Raj. Back in 2004, Raj decided to invest in a plot of land, purchasing it for ₹20,00,000. Fast forward to 2024, Raj finds that the value of the land has appreciated significantly, and he sells it for ₹1,24,00,000. Raj is now faced with calculating the tax on the profit he has made from this sale.

Scenario 1: Without Indexation (Current Tax System)

In the current tax system, without considering indexation benefits, Raj calculates his profit as follows:

- Purchase Price (2004): ₹20,00,000

- Selling Price (2024): ₹1,24,00,000

- Taxable Profit: ₹1,24,00,000 – ₹20,00,000 = ₹1,04,00,000

According to the 2024 Budget, the Long Term Capital Gains (LTCG) tax rate is now set at 12.5%. Therefore, the tax payable by Raj is:

- LTCG Tax: ₹1,04,00,000 * 12.5% = ₹13,00,000

Raj ends up paying ₹13,00,000 as tax on his profit from the land sale.

Scenario 2: With Indexation (Previous Tax System)

Under the previous tax system, Raj could benefit from indexation, which adjusts the asset’s purchase price for inflation, effectively reducing the taxable profit. The Cost Inflation Index (CII) for the years involved is as follows:

Using these values, Raj’s inflation-adjusted purchase price is calculated as:

- Indexed Purchase Price: ₹20,00,000 * (348 / 113) = ₹61,59,292

With this adjusted purchase price, Raj’s taxable profit becomes:

- Taxable Profit: ₹1,24,00,000 – ₹61,59,292 = ₹62,40,708

Under the previous system, the LTCG tax rate was 20%. Therefore, the tax payable by Raj is:

- LTCG Tax: ₹62,40,708 * 20% = ₹12,48,142

Comparison of Outcomes:

- Without Indexation (Current System): ₹13,00,000

- With Indexation (Previous System): ₹12,48,142

- If we consider the year 2024-2025 the CII value is 363 so the tax amount would be more cheaper which is ₹11,95,044.

Outcome:

Under the new system, Raj pays ₹13,00,000 instead of ₹12,48,142 with the previous system. This means Raj faces an additional tax burden of ₹51,858 due to the removal of indexation benefits.

GST (Goods and Services Tax):

- Basic Items: 5%-12%

- Example: Buying groceries worth ₹1,000 will include ₹120 as tax.

- Fancy Items: 18%

- Example: Purchasing a gadget worth ₹10,000 will include ₹1,800 as tax.

- Luxury Items: 28%

- Example: Buying a high-end smartphone worth ₹50,000 will include ₹14,000 as tax.

Unemployment and AI:

The Economic Survey also addresses the high unemployment rate among graduates (44.49% for ages 20-24 in early 2024) and the disruptive impact of Artificial Intelligence on jobs across all skill levels. To address these issues, the Finance Minister announced five schemes with an outlay of ₹2 trillion:

- First Time Employment Support: Those who join their first job and are registered with the Government’s EPFO can get up to ₹15,000 from the Government.

- Manufacturing Sector Benefits: More benefits for employees and employers in the manufacturing sector.

- Employer Support: To encourage employers to hire more employees, the government will contribute up to ₹3,000 per month for two years in the EPFO on behalf of the employers.

- Skilling Scheme: To help 2 million youth become skilled in the next five years.

- Internship Opportunities: Providing internship opportunities for 1 million youth in the top 500 companies for 12 months.

Impact on Investors:

Futures and Options Trading:

- Increased Securities Transaction Tax (STT):

- Futures: From 0.0125% to 0.02%

- Options: From 0.0625% to 0.1%

- Explanation: This makes speculative trading more costly, discouraging excessive market speculation.

Government’s Justification:

The Economic Survey 2023-2024 highlights concerns about the stock market becoming a bubble, which can lead to instability. The government aims to discourage excessive trading in futures and options to prevent market volatility.

Real Estate and Non-Financial Assets:

LTCG Tax on Property:

- Reduced from 20% to 12.5%.

- Removal of indexation benefits for properties bought after 2001.

Angel Tax:

- Start-ups: Removal of Angel Tax, which is beneficial for new businesses.

Income Tax Changes:

- Standard Deduction: Increased from ₹50,000 to ₹75,000.

- Example: If your salary is ₹8,00,000, you can deduct ₹75,000 before calculating taxable income.

Concerns for the Middle Class:

The Indian middle class might face several challenges due to these changes:

- Higher Tax Burden: The removal of indexation benefits means higher taxes on property sales.

- Increased GST: Higher rates on luxury items affect middle-class consumption.

- Unemployment: The growing impact of AI on job markets poses a threat to job security.

Relevant Sections of Taxation Law:

- Section 80D: Deductions for medical insurance.

- Section 80 TTA: Deductions for interest on savings accounts.

- Section 80TTB: Deductions for interest income for senior citizens.

- Section 54: Exemption on LTCG from the sale of residential property.

Conclusion:

The 2024 Budget has significant implications for various sectors, especially middle-class individuals and investors. The government’s intent is to curb speculation and stabilize the market, though the middle class may feel the pinch due to increased taxes on investments and property. Understanding these changes and how they affect your finances is crucial for effective tax planning and investment strategies.

🔍 Recommended Reading

For a more comprehensive understanding of the financial and economic issues addressed in the budget, we recommend exploring the following article:

- 📌 PROBLEMS OF INDIAN TAX SYSTEM - This article delves into the complexities and challenges of India's tax system, providing critical insights into the structural issues that impact the nation's economic disparities.

📰 Recommended Reading

To further explore how unethical practices disrupt key sectors like education, we recommend reading our in-depth analysis of paper leaks, particularly the NEET paper leak of 2024:

- 📌 Problems of Paper Leaks in India with Special Context of Recent NEET Paper Leak 2024 - Delve into the alarming trend of paper leaks in India, with a focus on its impact on competitive exams like NEET.